Ultimate Mortgage Lead Generation

For Brokers Who Need 50+ High Converting Monthly Leads

How do you generate all the mortgage broker leads you need? We know. Generate more profitable mortgage leads than before with Insite Web. Don’t buy, with a minimum monthly budget of £1.5K you can generate your own.

50+ Targeted Mortgage Leads pm, or Your Money Back

Improve Your Leads & ROI With Insite Web

At Insite Web we specialise in working with mortgage brokers and mortgage advisers to generate mortgage leads online. We’re don’t sell mortgage leads; we work with you to generate leads using your website and digital marketing strategy. These leads belong to and are controlled by you. You won’t share leads and you won’t be sent lists of low-quality leads. Together we create online processes that drive leads to your business.

Whether you want domestic or commercial mortgage leads, if you’ve been wasting money on digital marketing that doesn’t generate qualified leads, or spending your budget buying leads from lead generation companies who simply don’t understand your business, stop. Up your online mortgage lead generation game. Talk to Insite Web today and start using your own leads to build your business.

UK Mortgage Lead Generation Options – Results Guaranteed

How We Can Improve Lead Gen & Sales Performance

Mortgage Leads Types Available

How to generate mortgage leads online

If you buy mortgage broker leads from even the best mortgage lead generation companies, you might think you’re saving time and money. You may get cheap mortgage leads, but are you getting high-quality mortgage leads? A better way is to generate leads for mortgages online.

There are lots of ways you can generate mortgage leads online. These include pay-per-click (PPC) advertising, Facebook ads, search engine optimisation (SEO) and capturing leads through your website. The problem is not a lack of opportunity to generate online leads. The problem is that when any method is used ineffectively your company ends up with too few useful leads at a high cost or potentially many unqualified leads. The key to any online lead generation strategy is to research and understand the market for your services and then target them effectively.

As a mortgage broker you want to be put in touch with customers who are actively looking for mortgages; with people who are likely to become customers, not just because you offer what they are looking for, but also because they are the type of customers you are looking for.

What does this mean? Well, for example your company may specialise in providing mortgage broker services for first-time buyers. You want the leads you generate online to match the profile of your ideal client as closely as possible. This can be done through the use of qualifying processes and questions, known as funnels, which refine the leads generated so you get customers who are actually ready to go as first time buyers, with the right income, deposit and credit history.

How Insite Web can help with mortgage lead generation

We start by working closely with you to identify the services you provide, your USPs and then what type of leads you want. By carrying out this initial research, we can help you save time, money, and resources later on.

This research and consultancy process helps us understand both your business model and your market in order to structure your online presence. When we understand this we can start to create lead generation services that are tailored to you and your customers. That can be based on a vast array of customer variables; e.g. age, sex, affluence, employment, search keywords, geography, plus a whole lot more.

Mortgage Lead Generation Websites

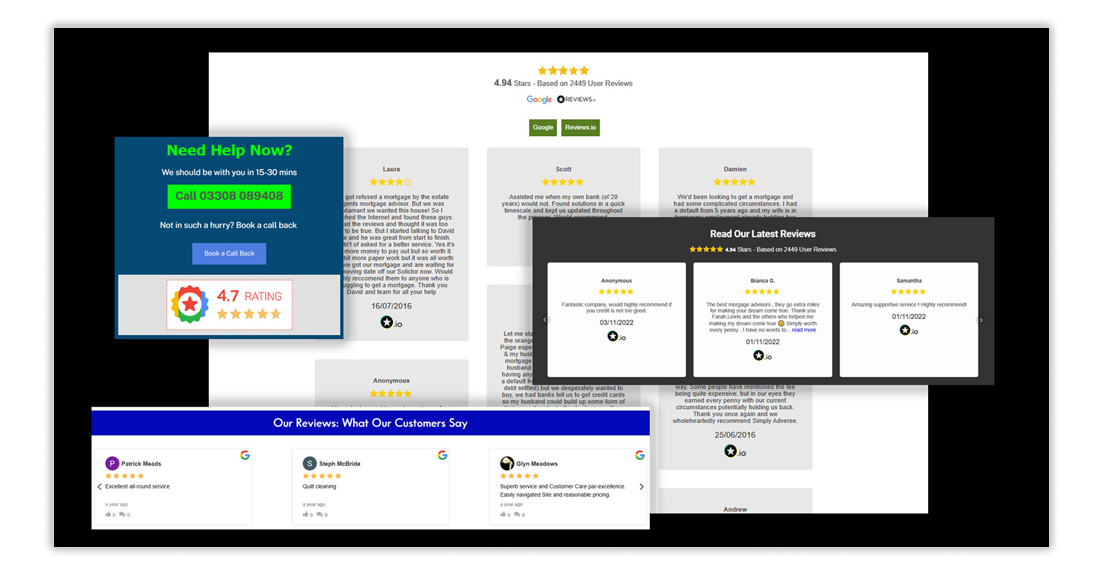

The best way to generate mortgage leads is via your website, as you’re driving customers to a place you can tell a great story about your brand and optimise the journey to convert targeted leads.

Insite Web can work with your existing website to target your services and customers, either by updating the current site and adding required content, or by redeveloping it completely for you. If this is difficult to do, or your initial budget doesn’t allow for this, we can also create bespoke landing pages on a subdomain. The benefit here is that these pages appear to be part of your website, but allows us to focus on lead generation quickly without having to have redevelop your current site.

Whichever model you choose we’ll ensure that the site used is optimised to generate qualified online leads attuned to your business.

We will work with you to determine the best range of marketing channels; from SEO programmes designed to achieve high page rankings in search engines and above average click through rates, to PPC campaigns for quick implementation. We’ll use a number of tools to enhance the leads you capture from your website’s visitors.

You can capture qualified leads on your website using many techniques including:-

- Well-designed forms and funnels

- Quizzes

- Chatbots

- Live chat

- Surveys

- Downloadable content

Your mortgage broker website may already use some of these strategies to capture leads, but if you’re not satisfied with the quality of leads they generate or you’re paying other companies to send leads to you, let us take a look at how they can be improved.

Get More Leads Now

Build A Bespoke PPC Quote

Exploring a variety of lead platforms

One of the reasons we take so much time understanding your business is because we want to understand where you customers are. This helps us create an online strategy that doesn’t waste time or effort, meaning we create content that both appeals to them and will be seen by them.

If the majority of your potential customers are searching on Google, or are on social media platforms, that’s where we’ll recommend you spend your budget.

PPC Mortgage Search Leads

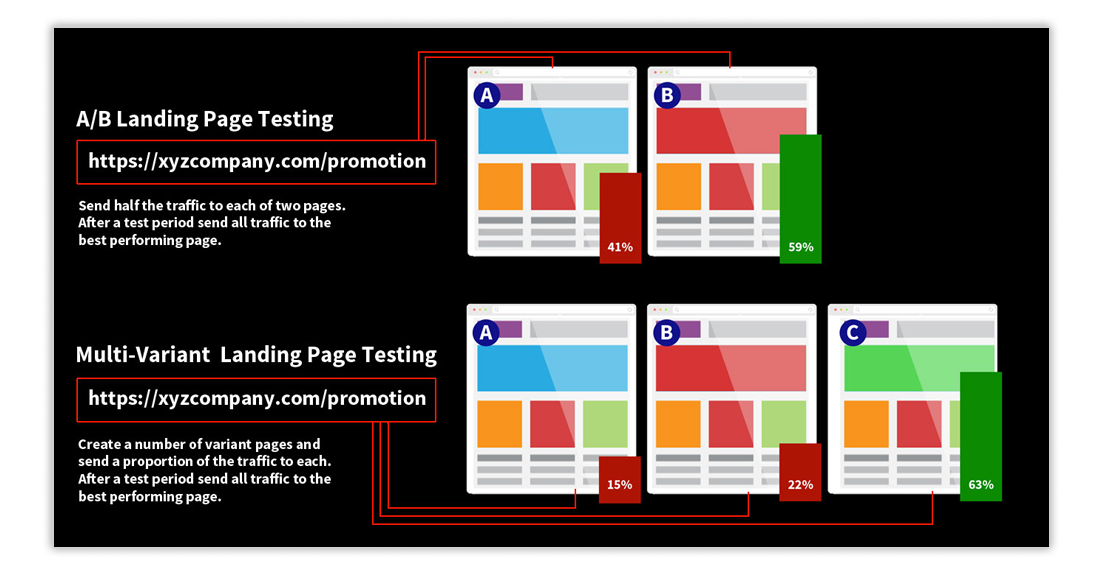

PPC search is an extremely effective tool for lead generation for mortgage brokers. Well-managed Google Ads and Bing (Microsoft) Ads campaigns allow targeting of messages via keywords and segmentation, which with advanced landing pages and data capture improve the quality of your mortgage broker leads. Messages can be easily controlled for each stage of the funnel, and A/B testing and analytics provide both budget control and the ability to test and fine-tune ads.

SEO Mortgage Broker Leads

An SEO programme targets organic search rankings to put your website in front of prospective customers by placing further up search results than your competitors. Key to SEO lead generation is the creation of high quality copy that uses relevant keywords that reflect the search terms that your customers actually use. This copy needs to provide the best information possible to for visitors and match the services you deliver and want to sell.

Phone/SMS leads

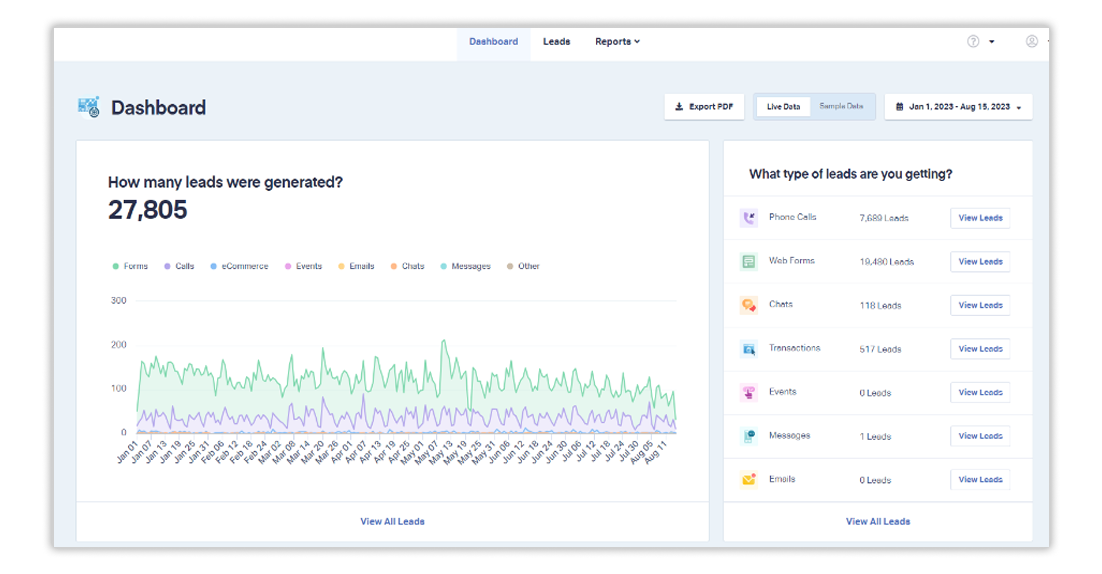

Phone lead generation allows full tracking of incoming calls, to determine where leads originated and identify the most successful marketing campaigns and platforms. We can implement full tracking of all calls from any source and integrate these into your marketing and mortgage leads campaigns.

SMS leads have the advantage of capturing demand and increasing conversions quickly, they are often more immediate than email and turn prospective browsers into online mortgage leads, as you stand and can encourage revisits to your website, or calls to your brokers.

Social Campaigns

We can use Facebook and LinkedIn to connect you with prospective mortgage customers, capture contact details and provide you with quality leads. This can be very targeted based on the mortgage demographic you’re interested in; e.g. you can target customers by age, affluence, likes and interests, showing relevant adverts and videos to your target audience. LinkedIn is particularly effective for B2B commercial mortgage leads and targeting high net worth customers.

Email Campaigns

From connecting with existing customers through regular eshots to tailored emails for new qualified leads gathered online; email campaigns keep customers engaged with relevant content targeted to the stage they are at in the lead generation funnel. They can be used to give additional tools and content; as an example you can share results of online questionnaires or forms, encouraging customers to supply their contact details in return for useful advice or support.

AI & Automation

All the strategies we use for mortgage leads are underpinned by automation and AI, both of which reduce the amount of human resource required to manage your processes. Both also allow deep analysis to inform strategy changes and improvements, meaning faster reactions and changes to keep you ahead of the competition.

Creating lead funnels

Our online lead generation strategies for mortgage brokers create effective funnels that sort out the time wasters from genuine prospective customers. We do this with a range of AI and online tools to ask questions and capture data without putting off prospective customers.

These funnels ascertain the likelihood of the customer being the right fit; e.g. we can capture income, services required, plus any other qualification questions to see if they need your service.

We then follow these up with targeted email campaigns, content marketing and social media to drive even more leads for you.

Talk to us today to get more leads

If you’re looking for the best way to generate mortgage broker leads, contact Insite Web now and get set to watch those mortgage leads pour in. We know how to generate leads for mortgage brokers.

Clients Who’ve Improved Their Leads & Data

Mortgage Broker Leads FAQs

Market Leading PPC Lead Generation

In the last 4 years we have driven 5 x the average click-through-rate and 6.5 x the average lead conversion results for our clients – See how we can help You Today

16.2% Average CTR Rate (click through rate)

Industry average = 3.17%

24.1% Average Conversion (lead/sale) Rate

Industry average = 3.75%

25% Average Cost Per Click (CPC) Reduction

The average reduction in cost per click we’ve achieved

155% Average ROI Performance Improvement

The average change in ROI from lead & cost improvements

Our data is based on all clients performance from 2019 to 2022, across a range of industries from ecommerce, through home improvement and leisure to finance leads (some clients see 40%+ conversion rates and far higher ROI). You can see a range of client performances and ROI data on Our Recent Work page.

Industry average CTR and Conversion data is based on WordStream Google Ads Industry Benchmarks updated for 2018 to 2022: https://www.wordstream.com/blog/ws/2016/02/29/google-adwords-industry-benchmarks

What Our Clients Say

* We will agree a performance target for fully optimised campaigns with you, if we don’t hit this target by month 3 we will give you a free month of our PPC services (you will still need to pay Google for clicks & any other marketing costs)